Data published today by the European Union's eurostat statistics service has revealed that in 2022, total road freight transport in the EU remained at the same level as in 2021 (1 920 billion tonne-kilometres).

The figures show that although there was a slight rise in international haulage as a whole, there was also a 8.9% drop in cabotage transports.

The figures show that although there was a slight rise in international haulage as a whole, there was also a 8.9% drop in cabotage transports.

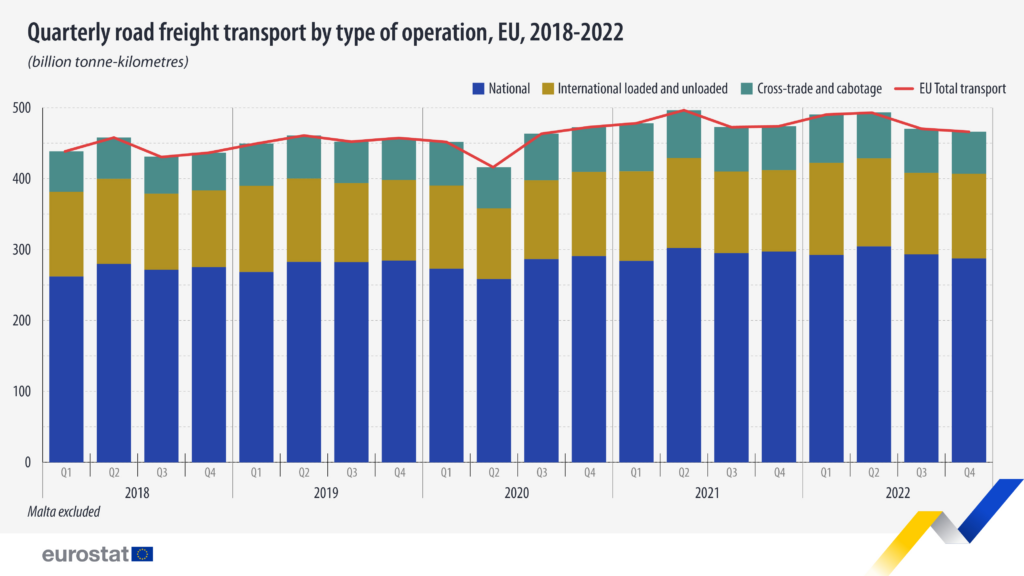

“Following some instability in the first and second quarters of 2020 due to COVID-related restrictions, in 2021 and 2022, road freight transport not only recovered but also showed an increase compared to years before 2020. Total EU road freight transport registered a higher performance in the first quarter of 2022 compared with the same quarter of the previous year (+2.6%) and small decreases in the following three quarters (-0.6 %, -0.5 % and -1.6 %, respectively), bringing the overall total transport to the same level as in 2021,” says Eurostat.

In terms of goods, in 2022, ‘food products, beverages and tobacco’ continued to dominate road freight transport, accounting for 317 billion tkm (16.6% of total tkm). Together with goods in the ‘agricultural products’ category, these collectively represent more than one quarter of the total road transport in tkm.

In terms of goods, in 2022, ‘food products, beverages and tobacco’ continued to dominate road freight transport, accounting for 317 billion tkm (16.6% of total tkm). Together with goods in the ‘agricultural products’ category, these collectively represent more than one quarter of the total road transport in tkm.

As for what kinds of goods were transported to varying degrees in 2021 and 2022, notable increases in performed tkm were registered for ‘equipment and material utilised in the transport of goods’ (+7.4%) and ‘mail, parcels’ (+4.7 %).

Meanwhile, decreases were recorded for ‘furniture’ (-6.2%), ‘chemicals, chemical products, and man-made fibres’ (-6.1%) and ‘wood and products of wood and cork’ (-5.3%).

Interestingly, the data shows that cabotage fell almost 9% last year:

“An analysis by type of operation shows that, in 2022, international transport performance (in tkm) increased by 1.0% compared with 2021, representing one quarter (25.4%) of total road freight transport in the EU. Since 2021, this type of operation has registered a strong increase compared with previous years. The other three types of operation: cabotage transport (-8.9%), national transport and cross-trade (both -0.1%), all saw a decrease in performance in 2022,” says eurostat.

Key influencers last year were of course the Russia’s invasion of Ukraine, which impacted the size of the truck driving workforce and increased fuel prices. Moreover, the new provisions of the Mobility Package, in particular the rules requiring both trucks and their drivers to return to base more frequently, may also have a had an impact.

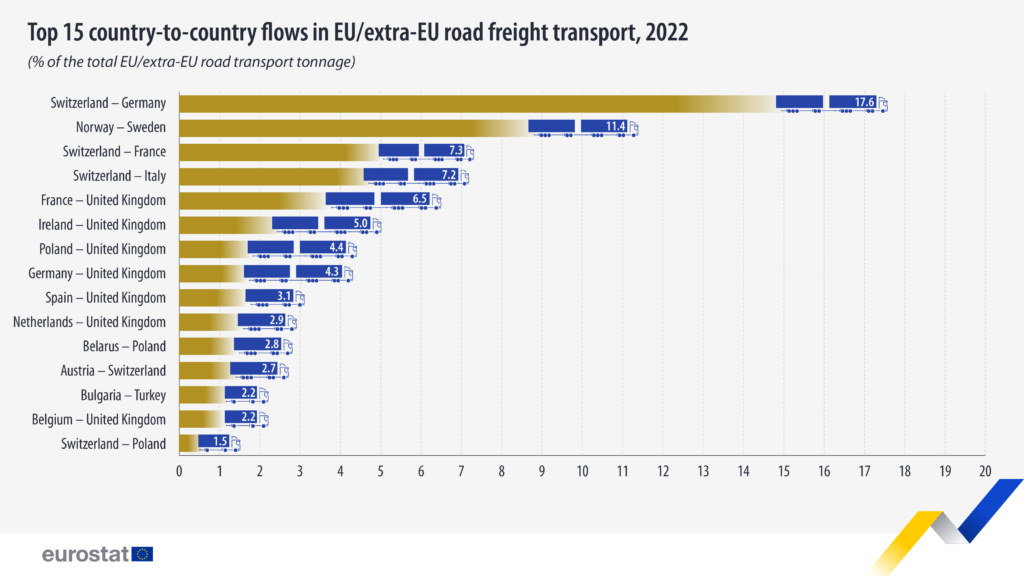

Eurostat also published a table illustrating the extent to which Switzerland, Norway, and the United Kingdom were important trading partners.

The three main flows, in terms of tonnes transported, were between Switzerland and Germany (17.6% of the total EU/extra-EU road transport tonnage), followed by the flow between Norway and Sweden (11.4%) and the flow between Switzerland and France (7.3%).